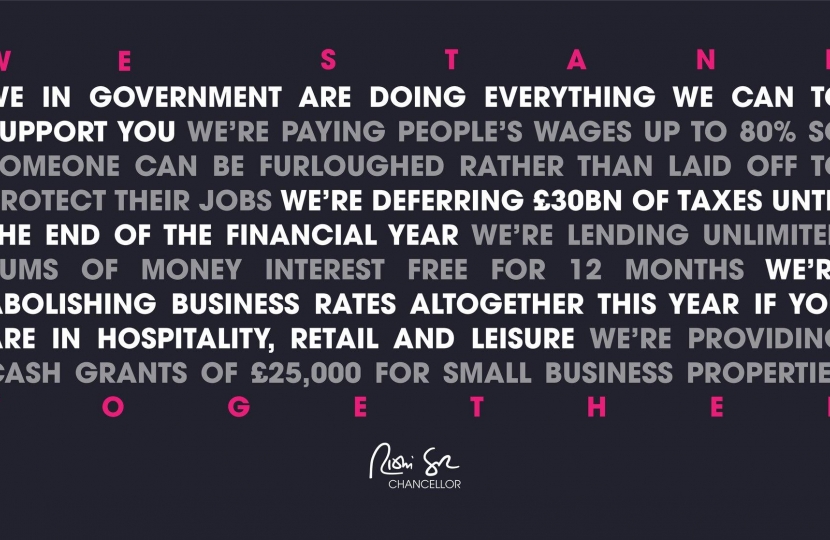

GOVERNMENT SUPPORT SUMMARY

Support for Large Businesses:

- Coronavirus Large Business Interruption Loan Scheme via commercial lenders

- COVID-19 Corporate Financing Facility run by the Bank of England

Support for Small and Medium Sized Enterprises (SMEs) via:

- Coronavirus Business Interruption Loan Scheme (CBILS) via commercial lenders

- Small Business (SB) and Retail/Leisure/Hospitality (RLH) Local Authority Grants

- Temporary extension of the Retail Discount Scheme for Business Rates to SB/RLH

- Coronavirus Statutory Sick Pay Rebate Scheme, where government covers cost of SSP

- VAT payment deferral, plus HMRC’s Time to Pay Scheme

- Extension of Rent Protection to Commercial Tenancies

Support for Household Incomes via:

- Coronavirus Job Retention Scheme (CJRS), where employees are furloughed on 80% pay

- Coronavirus Self-Employed Income Support Scheme (SEISS), for the self-employed

- Universal Credit (UC), which is more generous, easier to access and quicker to receive

- Rent and Mortgage Payment Holiday (plus protection against eviction) for three months

- Hardship Fund of £500 million, given to Local Authorities for Council Tax relief

Note: Each scheme has its own requirements for eligibility